- K-State home

- College of Health and Human Sciences

- Personal Financial Planning

- Student and Alumni Profiles

- PFP Newsletter

- Personal Financial Planning Newsletters

Spring 2024

From the Department Head

Alumni and Friends,

Alumni and Friends,

It was another year of growth and development for the Personal Financial Planning program and our students. We were excited to welcome new faculty, launch a new program at KSU Olathe, and experience continued growth at the undergraduate and graduate level. We were thrilled to have our first dedicated classroom, the Meritrust Credit Union Learning Laboratory, and to experience the resurgence in student engagement that it has facilitated. In this newsletter you will hear about all this and more. Thank you for being our extended family, please keep us up to date with what is going on in your personal and professional lives!

Martin Seay, Ph.D., CFP®

Department Updates...

Undergraduate Program

Derek Lawson, Undergraduate Director and Assistant Professor, provides an update on the undergraduate program and the comings and goings of our department.

FPA Competition Team

This team is chosen by our K-State PFP faculty to compete for a chance to be top 8 and have an all-expenses paid trip to FPA Annual in Columbus, OH, Sept. 18 - 20, in which they'd have to give a 20-minute presentation over three topical areas and compete in the 8-team knowledge bowl competition.

This year's team consists of three individuals who were hand-selected by our faculty based on their engagement and leadership in our program and adjacent programs, their level of understanding of past material, and their overall ability to collaborate and be a team member.

We are excited to announce this year’s FPA Competition Team …

|

|

|

| Aidan Little Senior |

Alonna Cross Junior |

Quinton Vlach Senior |

AFCPE Competition Team

The AFCPE competition is an opportunity to showcase financial counseling skills and knowledge and travel to the annual conference with the team. Our team will create a video and do a short case study to apply and then do a live knowledge bowl competition at the conference.

This year's team selection is....

|

|

|

Not Pictured |

| Katelyn Levesque Senior |

Josey Wolf Junior |

Sarah Biehler Senior |

Tyson Lanter Senior |

Graduating Seniors

We wanted to send a shoutout to our December 2023 and May 2024 graduating seniors. We are immensely proud and are looking forward to seeing what the future holds for each one.

Fall 2023 Graduates

Braeden Alan, Nicole Cilley, Emma Gustin, Trevor Henning, Cacy Larson, Matthew Wassenberg, and Isaiah Wilson. Congratulations!!!

Spring 2024 Graduates

Jack Caudle, Taylor Conroy, Cooper Courtney, Kaitlyn Crathorne, Matthew Edwards, Chase Erickson, Gavin Giroux, Jackson Harvey, Daniel Hensarling, Colin Higgins, Wyatt Hoffman, Brady Hogan, Andrew Leonard, Ty Lindenman, Jayde Madel, Trevor Martin, Nate Matlack, Maria Ortiz Santiago, Jonathan Oury, RJ Salmen, Ryan Smith, Wesley Spurgeon, Matthew Thompson, Kaden Walsh. You did it!!

Master's Program

The Master of Science in Personal Financial Planning program continues to exhibit remarkable growth, impressive retention rates, and significant industry influence. Currently, the program boasts an enrollment of 173 students across its various certificates and degree offerings. Among these, the Financial Therapy Certificate stands out as the most sought-after program. This certificate excels in equipping financial professionals with the essential skills to seamlessly integrate behavioral finance principles into their client interactions.

We are committed to continually enhancing and expanding our curriculum to meet the evolving needs of the financial planning profession. Our courses are meticulously designed to satisfy the educational requirements for numerous prestigious professional designations, including the Certified Financial Planner™ (CFP®), Certified Financial Therapist™ (CFT™), Accredited Financial Counselor® (AFC®), and Certified Financial Behavioral Specialist® (FBS®). This comprehensive approach ensures our graduates are well-prepared for a variety of professional certifications and career paths.

Our program has also seen substantial interest from individuals transitioning into financial planning from other careers, particularly those with backgrounds in the military and education sectors. These career changers bring a wealth of diverse experiences that enrich our learning environment and contribute to the dynamic nature of our program.

Moreover, our faculty members are dedicated to continuous professional development, exemplified by Dr. Henegar's recent achievement of the Chartered Financial Analyst® (CFA®) designation. Such accomplishments underscore our commitment to delivering the highest quality education and support to our students.

As we advance, our mission remains steadfast: to provide exceptional educational opportunities that prepare our students for successful careers in the financial planning industry. We are proud of the strides we have made and look forward to continued growth and impact within the field.

Doctoral Program

We are pleased to recognize the following Ph.D. students who completed their doctoral degrees this academic year: Efthymia Antonoudi, Gina Hall, Josh Harris, Jodi Krausman, Eric Ludwig, Julia Mull, Chris Ramel Strong, and Wendy Usrey. Congratulations!

Financial Futures Initiatives

Over the last two years, PFP has been a part of a combined university initiative to increase opportunities for students to improve their financial well-being. This year, the initiative focused on three things; helping students to develop a college financial plan within their first year on campus, providing on-demand access to peer-to-peer financial counseling services, and integrating financial well-being coursework into students’ curriculum. Through partnerships across campus, student engagement has exploded. This Fall alone, over 1,000 students received peer financial counseling services. In total, over 40% of all KSU students had exposure to financial literacy and well-being content.

A letter from the Advisory Board

The Personal Financial Planning (PFP) Department’s Advisory Board is focused on the support, growth, and ongoing success of its students and the program. Our board consists of experienced financial services professionals who bring their many years of experience and knowledge with insights into current trends in banking, investment management, trust services, and financial planning.

Advisory Board... (cont'd)

We are proud of the many accomplishments of our students, alumni, faculty, and staff, and through their efforts and achievements, K-State is considered one of the top three Financial Planning programs in the country. Our students have been successful at earning full-time professional positions and internships at over 30 financial institutions over nine states. They have proven to be valuable members of their respective teams and are terrific ambassadors for our Program and University!

On campus, PFP’s Financial Literacy program has reached nearly 8,000 students (approximately 40% of the Manhattan campus’ current enrollment), furthering their fellow students’ understanding of the important role personal finance plays in their lives. In July, K-State will once again host the Schwab Financial Planning at the Manhattan campus. In 2023, we welcomed over 25 high school students who completed mock financial plans and interacted with our current students, staff, and professional planners who are supportive of our program. Under the leadership of Armahn Hadjian, our Olathe campus is off to a terrific start! We began enrollment in the Fall of 2023 with two students and enrolled seven for the Spring 2024 semester. We are excited to bring our PFP program to the Kansas City area and expect continued increases in enrollment as the word gets out.

Across campus, our department has been having meaningful, collaborative conversations with related programs at the business school. We look forward to bridging those gaps and providing a complete educational experience to all students interested in finance.

Engagement with our alumni and industry professionals is key to our continued success! We welcome your thoughts, comments, or suggestions, so please feel free to reach out. It’s a good time to be a PFP Wildcat!

Best to you,

Todd YorkAdvisory Board Chair

Launch of the Olathe Program

Our Olathe PFP program launch happened this year, and just in the two semesters it has been available to the Kansas City areas, it has seen growth and exposure that will continue into the future as our Program Director, Armahn Hadjian, works the pavement and spreads the word. Continue reading to see what has been happening with our newest Olathe PFP program...

Olathe Program...(cont'd)

We are just wrapping up our second academic semester since the program's launch in Olathe. We have now taught PFP 305, 460, 462, and 464 each at least once. We started the spring semester with seven total students in the program. We have two new students admitted to start with us this summer and five more admitted and set to start with us this fall, which brings our total number of admits to 14. Beyond this, we have six additional prospective students who have expressed serious interest in the program and are either working with Jill Parker to submit transcripts or completing coursework at community college to achieve the 24 credits needed to begin with us. It is entirely plausible that on the one calendar year anniversary of the program's launch, we could have 20 students admitted.

Our primary student sourcing strategy thus far has been guest lectures at Johnson County Community College, as well as social media marketing. I have been able to connect with three faculty members who have invited me into their classrooms and generously given me an entire class period with each of their classes to talk exclusively about K-State PFP. I am hopeful that this will continue to drive students to not only K-State Olathe but also MHK for students who want to get the full college experience. We are in the final stages of completing an articulation agreement with JCCC. I have connected with other faculty who have expressed interest in me visiting their classrooms once the agreement is in place. JCCC has been an excellent partner, and I look forward to us continuing to expand this partnership.

In addition to our enrollment, we have several other initiatives in the works. First, we have assembled an Olathe PFP advisory board designed to build advocacy for the program with our firm partners. Our first meeting is May 22. We have seven confirmed board members.

The KC Chapter of FPA was able to offer a generous scholarship to all of our Olathe students currently enrolled. All are now FPA student members. All have also attended at least one chapter meeting. We have a unique opportunity at the Olathe campus to engage our students with the chapter and help them build relationships with firms in KC.

Last but not least, we are working on developing a summer financial planning academy similar to the one in MHK but scaled down to start. In alignment with our Manhattan program, we would focus on building financial literacy among high school students but perhaps also creating interest in the program itself for some students. Our current Olathe students are very excited about this, have expressed interest in helping with the academy, and even want to help promote the event to their former high school teachers. Our students seem very excited about financial planning; they are engaged and want to continue building this PFP student community at our Olathe campus in the image of our great MHK section.

Student Spotlight

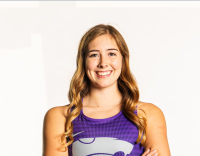

The Department of Personal Financial Planning loves to spotlight students doing great things, making connections, and leading the way for those who will come after. She's a student, an athlete, and an active member of the department. She was chosen as this year's student spotlight as she has shown passion and dedication to her academics, this unit, and the university through her work ethic, collaboration, and willingness to create connections on all levels. Our Spring 2024 Student Spotlight goes to Kenzie Storm, a junior majoring in Personal Financial Planning, minoring in Business, and working on her Kansas Insurance Certificate, as well as being a part of the K-State Rowing Team and a Student Office Assistant for the department. Please enjoy our Student Spotlight...

The Department of Personal Financial Planning loves to spotlight students doing great things, making connections, and leading the way for those who will come after. She's a student, an athlete, and an active member of the department. She was chosen as this year's student spotlight as she has shown passion and dedication to her academics, this unit, and the university through her work ethic, collaboration, and willingness to create connections on all levels. Our Spring 2024 Student Spotlight goes to Kenzie Storm, a junior majoring in Personal Financial Planning, minoring in Business, and working on her Kansas Insurance Certificate, as well as being a part of the K-State Rowing Team and a Student Office Assistant for the department. Please enjoy our Student Spotlight...

Spotlight... (cont'd)

Hello! My name is Kenzie Storm. I am a Junior majoring in Personal Financial Planning. I was recruited to K-State as a student-athlete for the rowing team. A fun fact about myself is that I never rowed before coming to K-State. I was recruited solely based on my height and my passion for athletics. I grew up in Webb City, Missouri, with my mom and dad, Julie and Dustin, and two older sisters, Sydnie and Allie. My dad is a superintendent for Miller Schools, and my mom is a teacher at Webb City High School. Both of my sisters are married, and I am the proud aunt of William, my 8-month-old nephew. Growing up, I have always shown an interest in math. I loved the money unit in elementary school and found that I still have a passion and mind for it. Along with my love for math, I also loved getting to know different people. In classes, it was never a worry who I sat by because this was an opportunity to make a new friend.

When I first came to K-State, I was a Bakery Science major hoping to become a Product Development Scientist, but I quickly found out that that career path wouldn’t lead me to what I am passionate about. After deciding that Bakery Science wasn’t for me, I started my search for a career that involved working with individuals one-on-one and being able to make an impact on someone's life. This search led me to PFP. I first met Jill Parker, my Academic Advisor, during Fall 2022 and immediately knew that PFP was the right major for me. On my first visit to the suite, I was introduced to a number of professors, and they were genuinely excited to meet me. Something that really stood out to me on my first visit was the amount of care the staff has for the students. Ms. Parker, or Jill as we know her, had me sit in on a behavioral finance class that Dr. Blake Gray was teaching before I officially changed my major, and that this was a change I really wanted to make. Instead of being viewed as “another student,” I was viewed as an individual person who they wanted to feel welcome and provided me with an opportunity to make sure this was the right call for me.

Coming into the Fall 2023 semester, I knew that I wanted to work, but I also knew that it could be difficult to find a job given my busy rowing schedule. When I heard about the student worker position in the PFP suite I immediately jumped at the opportunity to have flexible hours and to get the opportunity to work with my professors. Being a student worker has personally been one of the most beneficial things to me as a K-State student. I am able to work and assist my professors daily and have gotten to know them on a more personal level. I have especially enjoyed getting to go on “calcium runs'', also known as ice cream runs, with Professor Steve Levitt. Because of my position as a student worker, I have had extra networking opportunities, which have helped me tremendously in my growth and confidence as I work towards my goals and career. Rowing is a huge time commitment, so having this connection with the department has been maybe a less traditional way for me to stay involved and in the loop. With that being said, I am the treasurer of the Red Cross Club and also involved in a Life Group that meets weekly. This summer I will be doing the Amplified Planning Externship as well as working as a counselor for the K-State Financial Planning Academy. This is a week-long camp in the middle of July that can host up to 50 high schoolers wanting to dip their toe into personal financial planning and other related majors. I am also looking at becoming a Peer Mentor for our department in the fall so that I can hopefully help an underclassman or two, possibly another athlete, as they begin their journey through K-State and Personal Financial Planning.

I am so fortunate to have such great leaders and mentors in my program and this department. I have built great relationships with all the faculty and staff. Dr. Derek Lawson, Assistant Professor and the Undergraduate Director, has been a huge supporter as he has had many one-on-one conversations with me concerning my classes and working on conflicts that come up due to my athletics schedule. His door, like many others, is always open to me and my thoughts, concerns, and goal aspirations. Professor Steve Levitt is an adjunct faculty, who has really become a great resource for my questions as well as works with me regularly. As I think about who has made the biggest impact on my education from the faculty and staff, it is hard to pick just one. They have all offered themselves as a resource, and they have created a climate in the office that encourages communication and community among everyone. Having these connections with my professors has helped me gain confidence in what I am learning and has helped guide me into what I plan on looking for in a future career.

My anticipated graduation is May 2025, and my hope for post-graduation is to be able to find a firm or opportunity near the southwest Missouri area in an effort to be close to my home and family. I am so grateful that I found PFP and that I have had the opportunity to be set up for future success.

Check me out on LinkedIn.

Notable Research

Our faculty are teachers, mentors, professionals, and researchers, and as academics the research is where we can delve into the inefficiency and effectiveness of the profession, the environment of our clients and the personal financial planning arena.

Dr. Megan McCoy, assistant professor and an avid researcher and collaborator, has had a number of endeavors that have led to her sharing her and her team's research findings and opinions with a wide variety of platforms such as financial planning and finance journals, NPR, the Wall Street Journal, TIMES, and Apple News.

Research... (cont'd)

During her doctoral program, Megan developed a specialization in financial therapy and client psychology. She had the opportunity to work with clients alongside financial planning students to treat clients’ banking and other financial well-being issues together. Observing and learning from financial planners’ work with clients enabled her to gain more insights into the psychology of financial planning. As a result of her experiences, her research now focuses on the intersection of financial well-being and overall well-being – such as financial communication, financial socialization, and financial self-efficacy.

Currently, Dr. McCoy is working on a number of exciting projects with her fellow faculty members and graduate students. She and Dr. Blake Gray, Assistant Professor with K-State Department of Personal Financial Planning, and several graduate students (Donovan Sanchez, Khurram Naveed, Shane Heddy, and Billy Spencer) have been examining the Kansas State Annual Survey of Practitioners Pain Points and Opportunities which surveyed financial planners around the nation. The data collection and the ensuing projects were made possible through a partnership with the Financial Planning Association (FPA) and the Journal of Financial Planning.

The initial findings have illustrated three main pain points:

- Navigating client conflicts (including issues of using money as a source of power or control and dealing with the lack of financial transparency in couples’),

- When and how to make referrals to mental health practitioners and

- Identifying their own and their clients’ biases to make better financial recommendations.

Based on these pain points, they were able to infer the most common crises experienced in planning sessions with clients:

- Being scammed,

- Losing their partner/spouse,

- Receiving a life-altering medical diagnosis, and

- Determining when and if to stop financially supporting adult children.

On the flip side, they found that planners expressed a desire for research that helps better understand the ‘human’ experience of their clients. Although technical knowledge related to tax planning, insurance analyses, and retirement distribution strategies is vital to providing excellent service, financial advisors want research-based guidance on how to help their clients change behavior, improve communication, and better navigate crisis events. This includes a need for actionable research outputs that are accessible without the common barriers of academic paywalls and jargon.

It is Dr. McCoy and her teams hopes that this study becomes an annual survey for two reasons. First, it will allow university programs and other financial planning outlets to be informed about the most pressing needs regarding training for practitioners. The goal being it will inform webinars, trainings, courses, and microcredential offerings that actually meet planners’ needs. Second, it will become a resource for aspiring researchers on what topics should be focused on for future studies.

If interested in learning more, please feel free to reach out to Dr. Megan McCoy, Assistant Professor.

Scott McGehee, An Alumni Profile

Scott McGehee, CFP® and Senior Wealth Advisor is an alum who has proven time and time again to be an active member of his discipline, his community, and most importantly... his alma mater. As our Spring 2024 Alumni Profile, we asked the tough questions, and he did not disappoint…

McGehee Profile... (cont'd)

Tell us a little about yourself.

Tell us a little about yourself.

I currently work as a Senior Wealth Advisor with Mariner Wealth Advisors in Overland Park, KS.

I have been married to my high school sweetheart, Hannah, for the last five years, and we recently welcomed our first child, Penny Sue.

As a fourth-generation K-Stater and the 17th consecutive K-State graduate in the family descending from my Great-Grandma, Ida Conrow McGehee, I graduated from K-State in 2018. I received my Bachelor of Science in Personal Financial Planning with dual certificates in Professional Strategic Selling and Integrated Investment Management. It should go without saying, but I truly bleed K-State Purple and am a ‘Die Hard’ K-State sports fan…sometimes to a fault. I continue to be a football season ticket holder and make it to as many K-State games and events as possible.

What professional achievements are you most proud of?

Becoming and being a CFP®. It has helped guide me throughout my early career and is a baseline for being effective in the industry.

What kind of community-driven activities are you involved in?

I am involved with Big Brothers Big Sisters, the Leawood Chamber of Commerce, and KCHealthy Kids as well as being an active member of the Westside Family Church in Lenexa, KS.

When choosing your school/major, why did you choose K-State PFP?

I come from an extended family of both engineers and educators. My dad was an engineer, and my mom was a teacher. Financial planning is a beautiful marriage of technical analysis, trying to solve problems with math and logic, and being a guide and teacher who has to instruct people on new things in a way they can understand and, in a way, they’re willing to learn. I was always interested in financial planning, and decided to pursue an education that would prepare me to be one. As a senior in high school, I was going to major in finance and psychology. At the time, it felt like a good combo of the hard and soft sides of the industry. I was luckily introduced to the amazing Dr. Ann Coulson, who drove two hours to my hometown of Hesston, KS, to speak to me about personal financial planning as a major at K-State. I was sold immediately.

I was able to get to know my professors on a personal level and my classmates (thanks to relatively small classes) closely and dive deeply into the many great experiences and opportunities the program provides its students. K-State is the greatest place on earth – my school choice was easy! It just so happens that the greatest Personal Financial Planning program calls Manhattan home, as well.

How do you feel your education in PFP and your experience at K-State influenced your career?

More ways than can probably be described in a simple write-up.

The classes are in-depth. They prepare you for a CFP® exam and help cut down on typical industry training time once you get into the real world. Graduates are ready to be in front of clients and can immediately provide value to any firm.

The faculty and professors are the best in the business. They cared about the education I received, knew me by name, and set me up for professional and personal success.

There are travel and endless networking opportunities to get to know industry professionals.

They set me up with multiple internships with incredible firms, which helped me test my knowledge and get to the job I have today.

At K-State, I learned the technical side of financial planning, skills to assist in the soft side of guiding families through challenging financial decisions, and, above all, that the right way to provide financial advice is to put clients and their families’ best interests at the very top.

K-State is an amazing university. It embodies “family” and has a culture that is hard to beat. The Greek system (shout out Delta Upsilon Fraternity at K-State) provided experience in professional and personal development that you don’t find just anywhere.

Do you have recommendations/advice for our current students or future financial planners?

Get your CFP®!

Be patient—there is endless opportunity that can look how you want it to in the “real world.” It doesn’t come overnight.

Be a sponge—learn from faculty, classmates, and industry professionals. Research and study financial planning strategies. This doesn’t stop after graduation, either! Always, always learn.

Do your homework—talk with tons of firms and advisors to learn about what they do and how they serve their clients. Financial planners come in all shapes and sizes.

Build a network—attend FPA or NAPFA events. Find people smarter than you who can help answer questions you don’t know how to answer.

How do you think the career of Financial Planning/Wealth Investing will change in the next 5-10 years?

Financial planners will continue to need to know more and more as time goes on. It is no longer a profession of stock picking and insurance. You need to deeply understand tax, estate planning, retirement planning, and how to create a thorough financial plan (and still have deep knowledge of investments and insurance, too). Clients will continue to be more sensitive to fees charged, and you have to know a lot and provide a lot to truly be worth that fee.

The industry will keep getting younger! There is a huge need for young talent to enter and get involved in an aging industry. The industry is learning how to utilize young advisors from top-notch programs like K-State. The grass is getting greener and greener for any young CFP®.

How have you stayed involved with your Alma Mater?

You will find me in frequent attendance at sporting events and am a contributing member of WildcatNIL. I am a board member on both the K-State Delta Upsilon Fraternity and the K-State PFP Advisory Board. I provide student development through the Mariner internship as well as attendance of student networking events for K-State PFP and the College of Business. I have also been a guest speaker during several PFP classes and PFP club meetings.

Stay Connected on LinkedIn.

Pilot Program Connects 4-H Members to PFP 105

During the Spring 2024 semester, 11 high school students enrolled in PFP 105 as part of the Discover Your Future program, a unique pilot program offered by K-State Research and Extension and participating academic departments, including Personal Financial Planning. Through the program, students enrolled in one of three introductory courses offered asynchronously online and registered in an aligned 4-H project.

4-H Pilot Program... (cont'd)

The courses offered were Introduction to Personal Financial Planning, Introduction to Human Development, and Introduction to Agricultural Communications. All courses were self-paced and structured so that they did not interfere with students’ high school schedules or take away from school classroom instruction.

The program is designed to benefit 4-H youth by:

- Combining 4-H projects with advanced learning,

- Helping youth set goals, manage project expectations, increase knowledge and growth mindset within a project area, and

- Allowing youth to obtain dual high school and college credit (two or three credits, depending on the course).

Course objectives and CFP® principal knowledge topics covered were identical to those of the other sections of PFP 105 offered by the department. One of the projects students completed for the course involved an online mini-course developed by the Federal Reserve Banks of Richmond and San Francisco called Invest in What’s Next: Life After High School. Through the project, students developed a post-secondary plan while learning and applying economics and personal finance concepts and then tested their post-high school plans against real-life scenarios.

This initial, small-scale implementation was designed to assess program viability and work out any trouble-spots. The effectiveness of the program will be evaluated through TEVALS and other means. If appropriate, the Discover Your Future program may then become a regular opportunity for 4-H youth in Kansas.

If you have questions about this program, please reach out to Dr. Elizabeth Kiss, Professor & K-State Extension Specialist.

So Many New Faces...

Since our last newsletter in 2021, the faces that greet you in the PFP suite, lecture in our classrooms, and provide outreach initiatives have changed over the last several years. We proudly announce several new faculty members that make up this dream team of educators, researchers, and the like…

New Faces...(cont'd)

Mindy Joseph, Ph.D., CFP®, is a native New Yorker and proud alumna of Kansas State University, where she received her PhD in Personal Financial Planning. She completed her undergraduate degree in accounting at Syracuse University and has an MBA from DePaul University in Chicago. Mindy and her husband have lived in each section of the country, east and West Coast, Southeast and Southwest, but her arrival in Manhattan, KS, is her third stint in the Midwest. When she’s not packing and moving, a good book or a good movie paired with a cup of tea or a piece of chocolate is her paradise. She also developed a love for hiking during her time in Las Vegas and looks forward to frequent visits to the Konza Prairie Trail.

Mindy Joseph, Ph.D., CFP®, is a native New Yorker and proud alumna of Kansas State University, where she received her PhD in Personal Financial Planning. She completed her undergraduate degree in accounting at Syracuse University and has an MBA from DePaul University in Chicago. Mindy and her husband have lived in each section of the country, east and West Coast, Southeast and Southwest, but her arrival in Manhattan, KS, is her third stint in the Midwest. When she’s not packing and moving, a good book or a good movie paired with a cup of tea or a piece of chocolate is her paradise. She also developed a love for hiking during her time in Las Vegas and looks forward to frequent visits to the Konza Prairie Trail.

Blake Gray, Ph.D., CFP®, was born and raised in St. Johns, AZ, as the youngest of 10 children. Growing up, he was involved in everything he could: Soccer, basketball, academic decathlon, musicals, quartets, economics competitions, creative writing, questionable small-town wild activities, etc. He was even once in a ballet…. (small town, definitely was not qualified). He spent two years in the Philippines as a missionary and followed in his father’s footsteps by studying accountancy at Arizona State University. After college, he married Amanda, started working at Vanguard, got an MBA in Financial Planning, and kept playing a lot of soccer. He decided to continue his education at Texas Tech University and pursue his dream of being an educator (though he never dreamt of a Ph.D.) and obtained his Ph.D. in Personal Financial Planning. In June 2022, he moved to MHK and started working in the Personal Financial Planning department and has loved it. It would be tough to describe his main pursuits because they are so disparate. He loves spending time with his wife and 5 kids, helping students to become the best version of themselves, and supporting the MHK and KSU community to better envision and take hold of their financial future.

Blake Gray, Ph.D., CFP®, was born and raised in St. Johns, AZ, as the youngest of 10 children. Growing up, he was involved in everything he could: Soccer, basketball, academic decathlon, musicals, quartets, economics competitions, creative writing, questionable small-town wild activities, etc. He was even once in a ballet…. (small town, definitely was not qualified). He spent two years in the Philippines as a missionary and followed in his father’s footsteps by studying accountancy at Arizona State University. After college, he married Amanda, started working at Vanguard, got an MBA in Financial Planning, and kept playing a lot of soccer. He decided to continue his education at Texas Tech University and pursue his dream of being an educator (though he never dreamt of a Ph.D.) and obtained his Ph.D. in Personal Financial Planning. In June 2022, he moved to MHK and started working in the Personal Financial Planning department and has loved it. It would be tough to describe his main pursuits because they are so disparate. He loves spending time with his wife and 5 kids, helping students to become the best version of themselves, and supporting the MHK and KSU community to better envision and take hold of their financial future.

Armahn Hadjian, CFP®, CIMA®, owns a wealth advisory practice in Kansas City, MO, and is the Program Director for our Olathe program. He lives in the Northland area with his wife, his three children, and their new French Bulldog puppy, Millie. His oldest now calls Manhattan, KS her home during the school year. Hadjian is a graduate of the Kansas State Personal Financial Planning undergraduate program and graduates this May with a Master in Personal Financial Planning from K-State as well. He holds the CFP® and CIMA® designations. In his practice, he focuses on helping young information technology professionals build first-generation wealth through comprehensive financial planning.

Armahn Hadjian, CFP®, CIMA®, owns a wealth advisory practice in Kansas City, MO, and is the Program Director for our Olathe program. He lives in the Northland area with his wife, his three children, and their new French Bulldog puppy, Millie. His oldest now calls Manhattan, KS her home during the school year. Hadjian is a graduate of the Kansas State Personal Financial Planning undergraduate program and graduates this May with a Master in Personal Financial Planning from K-State as well. He holds the CFP® and CIMA® designations. In his practice, he focuses on helping young information technology professionals build first-generation wealth through comprehensive financial planning.

In his spare time, he and his family enjoy cooking, watching movies, and going for walks on one of several trails in the area. He is a lifelong Kansas City Chiefs fan and has always enjoyed playing and watching basically any sport. He just enjoys the competition and camaraderie that comes with sports.

Steve Levitt, CFP®, CFA, CPC, QPA, is an adjunct professor in K-State's Personal Financial Planning department. He is a relatively recent "retiree" with almost 30 years of financial services experience. Steve started his career in public accounting, specializing in taxation, and then migrated into financial services. He has worked for American Century Investments, JPMorgan Retirement Plan Services (both in Kansas City, MO.), and most recently at Vanguard in Scottsdale, AZ. Steve retired from Vanguard in June 2022 and relocated to Manhattan, KS, in November 2022. Upon relocating, Steve spent nine months as a Personal Financial Counselor working with the soldiers stationed at Fort Riley. He began teaching at K-State in August 2023.

Steve Levitt, CFP®, CFA, CPC, QPA, is an adjunct professor in K-State's Personal Financial Planning department. He is a relatively recent "retiree" with almost 30 years of financial services experience. Steve started his career in public accounting, specializing in taxation, and then migrated into financial services. He has worked for American Century Investments, JPMorgan Retirement Plan Services (both in Kansas City, MO.), and most recently at Vanguard in Scottsdale, AZ. Steve retired from Vanguard in June 2022 and relocated to Manhattan, KS, in November 2022. Upon relocating, Steve spent nine months as a Personal Financial Counselor working with the soldiers stationed at Fort Riley. He began teaching at K-State in August 2023.

Steve and his wife, Mary, have been married for 40 years. They have two daughters (both grown and married) and became first-time grandparents in March 2024. Steve and Mary enjoy traveling, hiking, biking, and spoiling their new grandson.

Congrong Ouyang, Ph.D., is an Assistant Professor within the Department of Personal Financial Planning at Kansas State University. She teaches both undergraduate and doctoral students, including estate planning, research methodologies, and the utilization of statistical software for financial planning research.

Dr. Ouyang holds a Bachelor of Science in Business Administration (B.S.B.A.) in Accounting, a Master of Science (M.S.) in Consumer Sciences and a Ph.D. in Consumer Science from The Ohio State University.

Dr. Ouyang’s research focuses on borrowing decisions, fintech, and various methodologies in financial planning research. Her work has been published in the Financial Services Review, Journal of Family and Economic Issues, Journal of Financial Planning, and Journal of Retirement among others. This year, Dr. Ouyang serves on the Editorial Board of the Financial Planning Review and grant reviewing committee for the Kansas State University Small Research Grant program.

Outside of work, Congrong enjoys hiking in areas like Konza Prairie near Manhattan, scuba diving, and spending time outdoors with family and friends.

Yu Zhang, Ph.D, AFC®, growing up was profoundly influenced by her parents, both dedicated doctors who balanced their medical practice with teaching. Their unwavering commitment to community wellness has continually inspired her. They instilled in her the value of applying one's passions to serve others, a principle that has not only guided her personal aspirations but also shaped her understanding that true wellness encompasses financial, psychological, and physical health.

Yu Zhang, Ph.D, AFC®, growing up was profoundly influenced by her parents, both dedicated doctors who balanced their medical practice with teaching. Their unwavering commitment to community wellness has continually inspired her. They instilled in her the value of applying one's passions to serve others, a principle that has not only guided her personal aspirations but also shaped her understanding that true wellness encompasses financial, psychological, and physical health.

Dr. Zhang's academic journey began in the field of finance and banking and personal finance during her undergraduate studies, where she discovered a deep passion for personal finance, driven by a head for business and a heart for people. This realization guided her to pursue a master’s degree in personal financial planning at the University of Missouri-Columbia, with an emphasis on research and policy. She continued to deepen her knowledge with a Ph.D. in financial planning at the University of Georgia, an experience filled with exhilarating challenges and unexpected personal developments. It was during her Ph.D. that she met her husband, enriching her personal life alongside her academic achievements.

She joined Kansas State University in 2023, where she met extraordinary colleagues who quickly became like family, enhancing the sense of community in her professional life. Moving forward, she is committed to propelling the field of personal financial planning forward through engaging teaching and innovative research.

Donor & Firm Support

We would not be able to support and provide our students with this level of education and community without the support of the larger community. You and the resources you give to our program and our students continue to keep us ranked as one of the top programs in the nation.

Support... (cont'd)

We wanted to thank all of our supporters that continue to make our program and the student experience that much better year after year. We have provide scholarships, renovated classrooms and our suite space, as well as provided students with unique opportunities through alumni and firm support and engagement via guest lecturing, classroom visits, and professional connection events.

A special thank you to the Meritrust Credit Union for the newly renovated classroom/learning lab space.

|

|

Closing Remarks

In closing, what an exciting year and semester! We have watched students mature and find a path of meaningful growth. We have seen them plug into community and initiatives and proudly watch them lean on one another, the faculty and staff, and their own two feet to become better planners and people. As we all know, this industry and profession would not be anything without...Head for Business, Heart for People.

Closing... (cont'd)

Last thoughts, initiatives, and resources to keep in mind...

Financial Planning Academy Summer Program

We are looking for 2024-2025 sophomores, juniors, and seniors in high school to join us for our Financial Planning Academy Summer Program at Kansas State University, funded by the Charles Schwab Foundation, July 14-19, 2024!

They'll spend an exciting week on K-State's campus in Manhattan, deepening their understanding of personal finance and the profession of financial planning. Interact with financial experts and further develop skills in leadership, communication, team building, entrepreneurship, marketing, and more.

During this program, our campers will:

-

- Collaborate with fellow participants on a case study.

- Take part in team-building challenges.

- Develop a financial plan.

- Compete for scholarships and prizes.

- Meet other students interested in a business-related career.

- Spend the week as a K-State student, living in the residence halls and utilizing the dining hall.

- If you are considering a career in finance or business, this program is for you!

This program is valued at $900, but through the generous support from the Charles Schwab Foundation, student registration is only $150.

We have a few seats left if you know of a high schooler wanting to dip their toe in financial planning in this immersive college experience.

If you have any questions regarding the program, please email us.

Do you have a Job or Internship you want us to share with our students?

If you want to promote an opportunity to our Personal Financial Planning students for an upcoming summer internship or post-graduation job, please let us know.

Is your high schooler starting to explore colleges? Schedule a Campus Visit TODAY...

Prospective students have a number of opportunities to visit campus and meet with programs. Explore K-State and the Personal Financial Planning program by scheduling your Campus Visit!

Interested in joining the College Professional Mentor program?

Are you interested in mentoring our students? The College of Health and Human Sciences provides a Professional Mentor Program for the students, pairing firm and industry individuals with students wanting a more indepth understanding of the profession or area they seek to work in. If interested in learning more about being a mentor, please visit the menotor website, or you can reach out to Dana Parker, Career Development Coordinator.